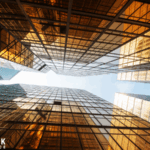

In a turbulent commercial real estate landscape, Simon Property Group persists in its resolve towards physical retail spaces as they navigate ongoing economic challenges. With shifting consumer behaviors, the company capitalizes on its strategic blend of strong asset quality and decisive investments to sustain its operations. This move comes amidst inflationary pressures and an evolving retail environment that frequently questions the viability of traditional brick-and-mortar outlets.

Earlier sentiments regarding the decline of physical retail are being constantly juxtaposed with new strategies that Simon Property Group employs to adapt and survive. Over previous years, eCommerce was seen as a substantial threat to physical retail, but recent approaches underscore a different narrative. By integrating digital platforms and investing in hybrid retail operations, alongside maintaining premium locations, Simon has shown an adaptability that resonates within the industry.

How is Simon Addressing Current Consumer Trends?

Amid heightened inflation and rising interest rates, physical retail locations remain appealing, particularly those located in well-trafficked, affluent areas. Simon Property Group has witnessed an occupancy rate of about 96% at its U.S. malls and premium outlets. This points to a sustained consumer interest in shopping in premium centers, despite the financial pressures affecting many households.

With a notable presence in economically strong and tourist-rich states such as Florida, California, and Texas, Simon’s strategy focuses on areas thriving due to migration trends and consistent luxury spending. The recent acquisition of full ownership of Brickell City Centre in Miami reinforces this strategy, emphasizing the importance of possessing key urban assets in prime markets.

What Challenges Does Simon Face?

Operating amid global economic uncertainty, Simon must contend with broader macroeconomic and structural risks. Online retail remains a formidable competitor, particularly for commodity categories. Additionally, challenges such as lease renegotiations and tenant issues are highlighted as areas to monitor closely. Global factors, including geopolitical tensions and currency fluctuations, present further complexities for Simon’s operations.

“We delivered another successful quarter, driven by the quality of our portfolio and disciplined execution,” stated David Simon, the company’s President and CEO.

Despite these challenges, Simon’s strategic focus on diversification and its tier-one property locations serve as a stabilizing force. The management emphasizes disciplined cost management as a key element of their resilience strategy. By leveraging its broad real estate platform, Simon aims to continue generating consistent cash flow, asserting that a strong community presence can endure economic turbulence.

A report on global shopping behaviors underscores a growing consumer preference for journeys that blend digital and physical shopping experiences. Simon’s investment in hybrid retail operators reflects this shift towards a more integrated retail landscape, as shoppers increasingly demand seamless interactions across channels.

“Our strategic investments and A-rated balance sheet position us for sustained long-term cash flow growth,” added Simon.

The trend towards merging digital and physical retail experiences is indicative of a broader industry evolution rather than a complete overhaul. For Simon, maintaining a strategic balance between online platforms and physical assets could prove vital. Positioned with some of the best locations, Simon’s sustained focus on quality and consumer confidence might offer a way forward amidst ongoing market disruptions.