Disclaimer: This article is a press release. COINTURK FINANCE is not responsible for any damage or loss related to any product or service mentioned in this article. COINTURK FINANCE recommends that readers carefully research the company mentioned in the article.

You need a reliable crypto exchange to start your trading journey, as these platforms are entry points into the crypto market. But with thousands of trading platforms competing for a spot, it can be challenging to decide on the best one for your needs. As highlighted by CryptoNinjas, reviewing and comparing exchanges based on their offers can help you find the right platform to manage your crypto investments.

Step 1: Review the Platform’s Security Setup

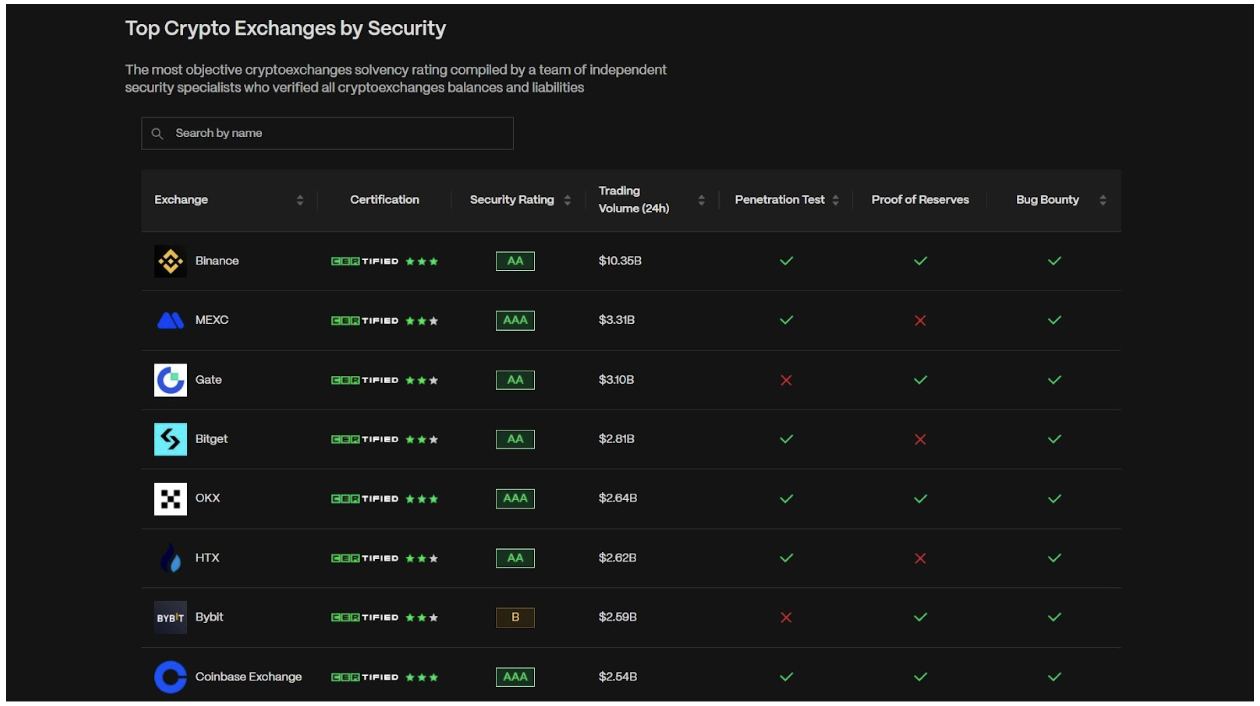

Security should be the first thing you check before using any exchange. Every platform protects users’ funds differently, so a quick look at the security measures in place can help you determine the level of protection you will have when you start using any trading platform.

For instance, some exchanges employ simple login methods, while others incorporate features such as multi-factor authentication, withdrawal approvals, anti-phishing codes, and clear security guidelines. These steps prevent unauthorized access and help keep your account safe.

Aside from the existing security features, the company’s history also offers valuable insight. Platforms that address past incidents openly and resolve them without delay tend to inspire more confidence over time. With this in mind, you can start your research on platform security by doing a side-by-side comparison of the best crypto exchanges.

Step 2: Examine Available Assets and Trading Options

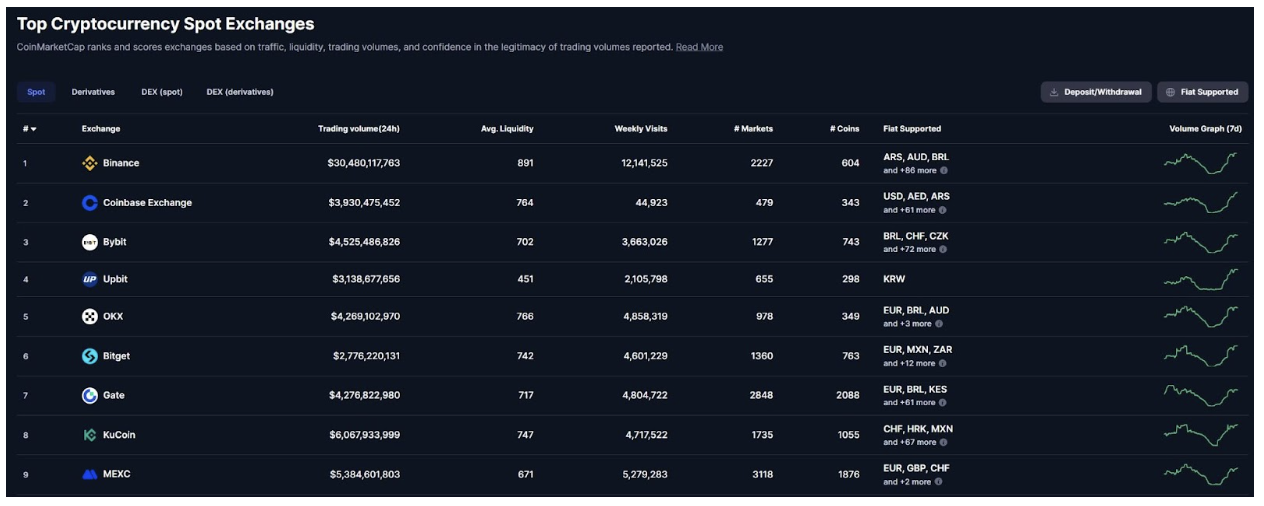

Every exchange supports a different range of assets. Some limit their focus to major coins, while others offer a broader list that includes newer or less common projects. For example, Binance, MEXC, and Gate.io support a wide variety of coins and trading pairs to choose from. The first supports over 500 cryptocurrencies, MEXC supports more than 2,500, while Gate.io supports over 3,000 coins.

However, the number of supported cryptocurrencies, trading pairs, and trading options should not be your only focus when choosing a crypto exchange. .

Step 3: Compare Fees and Transaction Costs

Fee structures vary across platforms, these charges influence the total cost of trading over time. Trading fees, withdrawal charges, and other small deductions can add up significantly for users who trade frequently. Maker and taker fees also differ between platforms, and some exchanges offer reduced rates for high-volume accounts or for those who hold the platform’s token.

Step 4: Evaluate Ease of Use

A reliable exchange should be easy to navigate and maintain maximum uptime even during peak market periods. Clear menus, simple order placement, and organized account settings make daily activity smoother. A platform that loads quickly and responds without delays also supports better decision-making and helps you enter and exit positions with minimal slippage.

Step 5: Check Liquidity and Trading Volume

Liquidity plays a crucial role in determining how smoothly trades are executed. A platform with steady trading volume can process orders quickly and at prices closer to what you expect. Low liquidity often leads to delays or noticeable price differences between the order you place and the final result.

Step 6: Review Customer Support and Communication

When issues arise, a quick response can prevent unnecessary delays or confusion. It helps to check the support channels available, such as live chat, email assistance, or a help center with clear guides. It is also important to examine how the platform communicates updates or service changes, as well as user reviews on online review platforms.

Step 7: Confirm Regulatory Standing and Operational Transparency

A good exchange should operate with clear regulatory compliance. This includes meeting industry requirements, adhering to regional guidelines, and providing transparent information about how the platform is managed. Transparent operations reduce uncertainty and help users understand the standards the platform follows.

A quick review of licenses, public audits, or proof of reserves can give a clearer picture of how the exchange handles user funds. Platforms that maintain open reporting and are licensed by top regulatory bodies in various regions provide a more secure and predictable trading environment for long-term use.

Next Read: UK FCA Eases Regulations for Cryptocurrency Firms

Conclusion

Choosing a cryptocurrency exchange becomes easier when you review factors that affect your trading activity and investments. It is advisable to do your own research (DYOR) on security, available assets, fees, liquidity, usability, support, and regulatory standing to gain a clear understanding of how well a platform can support your daily activities.

Disclaimer: This article is a press release. COINTURK FINANCE is not responsible for any damage or loss related to any product or service mentioned in this article. COINTURK FINANCE recommends that readers carefully research the company mentioned in the article.